The first step in using seasonal trends to explain patterns is to identify them. Using user-generated photos or reviews as proof of seasonality can help customers feel confident about their experiences with your brand. These photos or reviews can also be embedded into your emails to remind customers to leave reviews. This way, you can remind customers that others rely on your feedback.

Identifying seasonality in a time series

A time series is considered seasonal when it has a consistent and predictable pattern that occurs at regular intervals less than one year. Seasonality can be caused by a number of factors. For instance, the Christmas shopping season is highly seasonal, and shoppers make many purchases around the holidays. This type of pattern is often used to forecast future trends or to guide company decisions.

The easiest way to identify seasonality is to plot a time series on several different scales. Alternatively, you can use a continuous wavelet transform, which lets you detect seasonality through a time series’s evolution. This transform takes time series data and converts it into sine or cosine waves with different frequencies. The power of each frequency is then calculated.

Using the statsmodels library, you can analyze a time series by identifying its seasonal components. This will help you determine which period to target for specific activities. You can also use this library to compare different time series and find out whether they show a pattern of seasonality. This analysis is particularly helpful for forecasting and identifying when to invest resources.

A study was conducted to compare the results of different methods for classifying a time series as seasonal. It found that the QS method classifies time series as seasonal in 2809.9% of the time, while the AA method produces a higher proportion. However, this does not always happen and the results of this study show that the concordance between different methods depends on the data and database used.

The OPTUM DOD database has a very high concordance value. The database classifies 2809 time series as seasonal and 1498 as non-seasonal. The results are highlighted in green, yellow, and red, according to their 5% confidence levels. The average variance of these time series is 0.031 and the maximum variance is 18.4.

Quantifying seasonality

Quantifying seasonality is an important part of economic research and can help you better understand the behavior of the market. The process involves identifying the season in a time series and measuring changes over time. Then, you can use the data to calculate the seasonality. Once you have determined the seasonality of a particular series, you can use it to make decisions about stocks or economic trends.

One of the ways to quantify seasonality is to use time series decomposition. This method is helpful for estimating the strength of a trend. A series with low seasonal strength will have very little variation. A series with high seasonality will have a FS close to one and a small variance (Var(St+Rt)). These measures can help you determine which series has the strongest seasonality and trends.

Another method for estimating seasonality is to perform a run sequence plot. While this method sometimes indicates seasonality, it is more effective to use a seasonal subseries plot. This technique allows you to see the seasonality within and between groups. This method is also easier to read, particularly for large data sets.

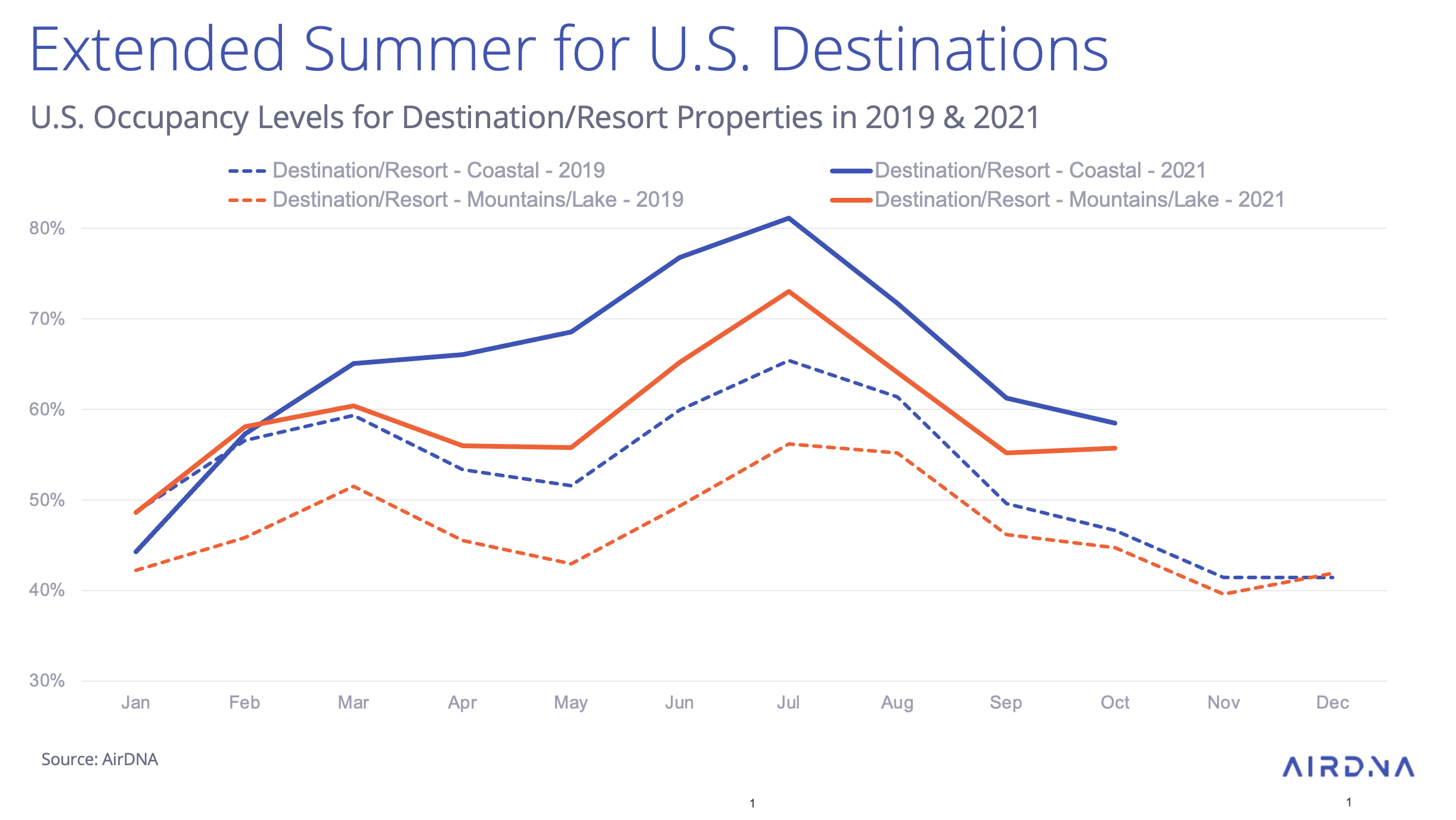

You can also use the seasonal index to determine the seasonal variation of a variable. A seasonal index measures the change that a variable undergoes because of seasonal changes in demand. For example, a hotel located on a beach might have higher occupancy during the summer months than in the fall. This seasonal index can be calculated with a spreadsheet program such as Microsoft Excel.

Another method for assessing seasonality is Fourier analysis. This technique simulates seasonality using a sum of sine or cosine terms. This approach makes seasonality a series of sine or cosine values, whereas a sinusoidal model uses a single sine or cosine term for each data point.

When using this method, you should first determine whether your data series contains a seasonal component. The seasonal component is most likely a sine wave that has a fixed period and amplitude. Then, you can use a curve-fitting approach to approximate it. After fitting a model to your data, you can determine the seasonal component for any time index, such as day of the year.

Dealing with seasonality

Seasonality is an issue that affects nearly every industry. Even if you’re not in the tourism industry, it can affect your revenue streams. One way to deal with seasonality is to offer a Product-as-a-Service. While this strategy isn’t for every industry, it can be very effective for certain types of businesses.

Seasonality can be difficult to predict. If you don’t understand the seasonality of your industry, you may not be able to accurately project your sales volume for the next few years. It’s essential to gather sales data from two or three years ago and from industry sources to determine the exact impact of seasonality on your business. Additionally, you can plan ahead by storing cash reserves to tide you over the slow months. During the slow times, you can also hire extra staff to prepare for the peak season.

Understanding seasonal inventory is crucial for any industry. For example, snow boots manufacturers know that they’ll need to produce a certain number of snow boots in November. By optimizing production lines, they can produce more than the volume they need to sell, creating a reasonable stockpile to store for the winter.

While the concept of seasonality may seem simple at first, it can be difficult to navigate. It requires careful planning and careful management of the supply chain. Many businesses struggle to manage low cashflow during slow periods, which makes it difficult to be profitable. However, by using smart practices, you can remain profitable even during slow times.

A new scheme is emerging that deals with seasonality in time series forecasting. This method builds a different model for each season. The experimental results of this model are more reliable than classical approaches. It also has an advantage over other models in terms of accuracy. For instance, it produces better predictions than the base case.

When using machine learning for time series analysis, seasonality can throw a monkey wrench into your models. The key is to decompose the data and fit a model to its components. This way, you can determine which factors are the causes of the seasonality of the signal and align promotions accordingly.